Business Deductions 2024 Tax – While simple math errors don’t usually trigger a full-blown examination by the IRS, they will garner extra scrutiny and slow down the completion of your return. So can entering your Social Security . Ready or not, the 2024 tax filing season is here. As of January 29, the IRS is accepting and processing tax returns for 2023. The agency expects more than 128 million returns to be filed before the .

Business Deductions 2024 Tax

Source : www.freshbooks.comThe Ultimate 2024 Tax Deductions Checklist for Insurance Agents

Source : blog.newhorizonsmktg.comThe Ultimate 2024 Tax Deductions Checklist for Insurance Agents

Source : blog.newhorizonsmktg.comThe Ultimate 2024 Tax Deductions Checklist for Insurance Agents

Source : blog.newhorizonsmktg.comLower Your Taxes Big Time! 2023 2024: Small Business Wealth

Amazon.com: Small Business Taxes Mastery 2024: A Step by Step

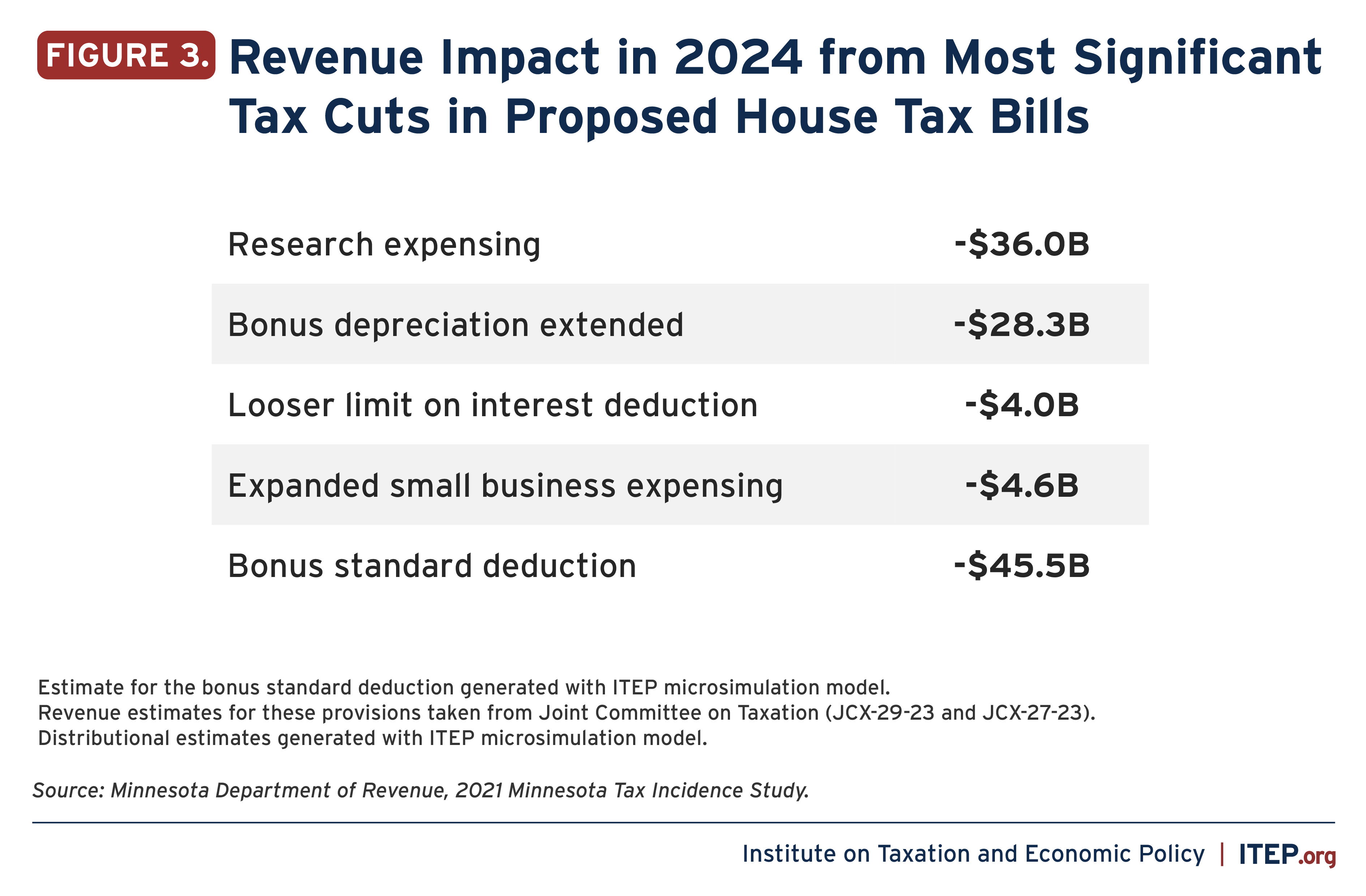

Source : www.amazon.comTrio of GOP Tax Bills Would Expand Corporate Tax Breaks While

Source : itep.orgYour First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.comSection 179 Tax Deduction for 2024 | Section179.Org

Source : www.section179.orgBusiness Interest Deduction: A Guide for Business Owners | Castro

Source : www.castroandco.comBusiness Deductions 2024 Tax 25 Small Business Tax Deductions To Know in 2024: There is broad agreement among tax policy experts that the current moment in the United States is one of great uncertainty with respect to future tax policies. If no action is taken by Congress, the . January 29 is the official start of the 2024 tax filing season. That means starting Monday through April 15, you can file your 2023 returns. .

]]>